Antigua And Barbuda Gambling License

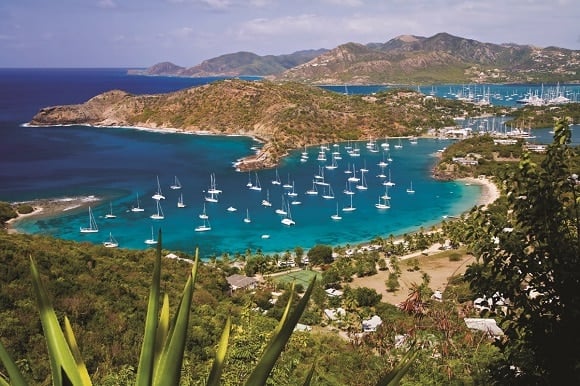

Gambling License in Antigua and Barbuda – Gaming Jurisdiction Tourism is the driving force behind the Antigua and Barbuda nation. It accounts for almost 60% of the gross domestic product. But the gambling license fiscal structure is the hidden motor of its economy. Antigua & Barbuda gambling licensing. Antigua and Barbuda has been the first island country to regulate & license online gambling. In 1994 it became the 1st online gambling casino jurisdiction in the world that had responsibility for making the first step to the international online gambling industry.

Antigua and Barbuda Jurisdiction Overview

The twin island Caribbean state Antigua and Barbuda has been practicing the tradition of the English common law since its declaration of independence in 1981. The legal procedures of the state are carried out by the pattern of the British parliamentary system conditioned by strong principles of democracy.

Antigua And Barbuda Gambling Licenses

In 1982, legislation was enacted under the International Business Corporations Act, with subsequent amendments in 1984 and 1985, to make Antigua and Barbuda a choice jurisdiction for offshore banking. Operations under this Act are controlled by the Ministry of Finance in Antigua.

Antigua and Barbuda legislation offers offshore businesses an opportunity of fast formation and relatively low fees and charges. The formation can be carried out by a locally registered trust company or by an accountant or attorney. A formation of an offshore company can be fulfilled within only 24 hours. The state offers the following corporate and trust services for both private and corporate companies:

- Registration and maintenance of corporate charters for offshore companies;

- Reception, management, and disbursement of the assets of offshore companies;

- Provision and maintenance of a registered office;

- Maintenance of the company’s records and statutory register;

- Preparation of all necessary corporate returns and reports to the Director;

- Provision of directors and officers on request;

- Incorporation and management of offshore banks and captive insurance companies; and

- A full range of traditional trust services.

Among the benefits of launching an offshore company in Antigua and Barbuda one can name:

- full tax exemption of all direct taxes for any international investment;

- only 3% tax on gross income;

- no minimum capital for international business corporation;

- transfer of charter of an international business corporation to a foreign jurisdiction or visa versa;

- permit to have only one single member in a board of directors.

Antigua and Barbuda Online Gambling Licensing

The licensing and regulation of online gambling services on the islands of Antigua and Barbuda is handled by the Financial Services Regulatory Commission’s (FSRC)division of gaming. The FSRC Gaming Division awards two types of licenses: interactive gaming (casino games and poker) and interactive wagering (sports betting).

Online gambling business operators registered in Antigua and Barbuda offer their players the so called ‘account betting’, i.e. a player is obliged to fund their account before he/she is enabled to enter into wagers. No credit can be offered to any player, which means that they cannot wager on a money amount larger than that they have on their account. f a wager is lost, the amount of the bet is taken from the player’s account for the benefit of the operator. If the player wins, the winnings are credited to the account. Players may request that all or any portion of the funds in their account be directed back to them.

The Antigua and Barbuda gaming authorities regulation include the following aspects:

Antigua And Barbuda Gambling License Plate

- Strict licensing requirements. The regulations of the state are rather tough, and every online gambling business operator licensed in Antigua and Barbuda is obliged to comply with every rule and regulation. Moreover, every licensee is subjected to a regular comprehensive due diligence review.

- Player account regulations. Under these regulations an online casino or other remote gambling business must perform a full registration of every player and verify their identities before activating their account.

- Age limitations. Online gambling websites are not permitted to accept wagers from underage players.

- Responsible gambling. Any Antigua and Barbuda licensee must be highly committed to responsible gambling. Online gaming websites must include all warning information to assist vulnerable gamblers.

- Anti-Fraud and Money Laundering Regulations. The regulations ensure honest play and that account wagering systems cannot be used by players to launder money.

Fees and taxation

Antigua And Barbuda Gambling License Bureau

The applicants must pay a USD $10,000 non-refundable fee for the due diligence process and USD $1,000 for every key person.

The annual license fee is USD $75,000 for online gambling and USD $50,000 for online wagering. Annual payments for a key person amount to USD $1,000 for the first year, and USD $250 for subsequent years.

Annual fee for the license renewal is USD $ 5,000 with additional charges if an investigation fees exceed the amount.

More information about online gambling licensing can be found at www.antiguagaming.gov.ag.